Embark on the journey of finding the best car insurance deals with Shop Car Insurance Quotes to Get the Lowest Annual Premiums. Discover how this simple yet crucial step can save you money and provide optimal coverage for your vehicle.

Delve into the world of car insurance comparison and unlock the secrets to securing the most cost-effective premiums without compromising on quality.

Importance of Shopping Car Insurance Quotes

Shopping around for car insurance quotes is a crucial step in finding the best coverage at the lowest annual premiums. By exploring different options from various providers, you can ensure that you are getting the most value for your money and adequate protection for your vehicle.

Comparing Quotes for the Best Coverage

When you compare car insurance quotes from different providers, you can tailor your coverage to meet your specific needs. This means you can choose the right level of protection for your vehicle without paying for unnecessary extras.

By shopping around, you can avoid overpaying for coverage that you may not need.

Getting the Lowest Annual Premiums

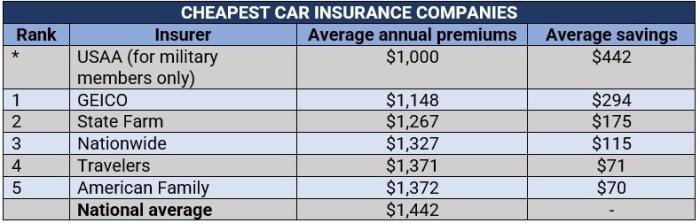

One of the key benefits of shopping for car insurance quotes is the opportunity to find the lowest annual premiums. Different providers offer varying rates based on factors such as your driving record, vehicle type, and location. By comparing quotes, you can identify the most affordable option that still offers comprehensive coverage.

Exploring different quotes can potentially save you hundreds of dollars annually on your car insurance premiums.

Exploring Different Options

Each car insurance provider has unique offerings and discounts that may benefit you. By shopping around, you can uncover special deals or incentives that could lower your premiums even further. Additionally, evaluating multiple quotes gives you a comprehensive view of the market, allowing you to make an informed decision based on both price and coverage.

Factors Affecting Car Insurance Premiums

When it comes to car insurance premiums, several key factors come into play, influencing how much you’ll pay for coverage. Understanding these factors can help you make informed decisions to get the best rates possible.

Personal Factors Impact

- Age: Younger drivers typically face higher premiums due to their lack of driving experience and higher risk of accidents.

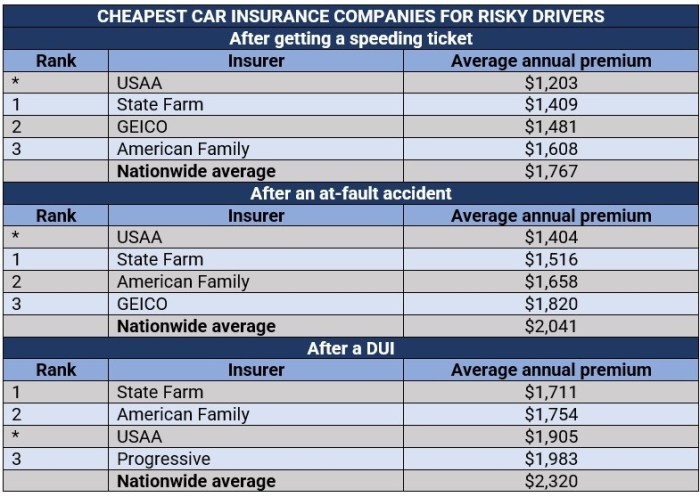

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or tickets may increase rates.

- Location: Where you live can affect your premiums, with urban areas often having higher rates due to increased traffic and theft rates.

Policy-related Factors

- Type of Coverage: The level of coverage you choose, such as liability-only or comprehensive, will impact your premiums.

- Deductible Amount: A higher deductible can lower your premiums but will require you to pay more out of pocket in the event of a claim.

- Vehicle Make/Model: The make and model of your car can affect premiums, with luxury or high-performance vehicles typically costing more to insure.

Tips for Getting the Lowest Annual Premiums

When it comes to lowering your car insurance premiums, there are several strategies you can employ to save money in the long run. From maintaining a good driving record to taking advantage of discounts, here are some tips to help you secure the lowest annual premiums possible.

Maintain a Good Driving Record

Maintaining a good driving record is crucial when it comes to securing lower car insurance rates. Avoiding accidents and traffic violations can help demonstrate to insurance companies that you are a safe driver, which can result in lower premiums over time.

Bundle Policies

One effective way to lower your car insurance premiums is by bundling multiple insurance policies with the same provider. By combining your auto insurance with other policies such as home or renters insurance, you may be eligible for a multi-policy discount, resulting in overall savings on your premiums.

Improve Your Credit Score

Believe it or not, your credit score can impact your car insurance premiums. Insurance companies often use credit information to determine rates, so maintaining a good credit score can help you secure lower premiums. Be sure to regularly check your credit report and take steps to improve your score if needed.

Seek Discounts

Insurance companies offer a variety of discounts that you may qualify for based on factors such as your driving habits, vehicle safety features, or membership in certain organizations. Be sure to inquire about available discounts with your insurance provider to see if you can further reduce your annual premiums.

Comparing Car Insurance Quotes Effectively

When it comes to comparing car insurance quotes effectively, taking the time to carefully review and analyze the details can help you make an informed decision that suits your needs and budget. Here’s how you can navigate the process seamlessly:

Importance of Reviewing Coverage Limits, Deductibles, and Exclusions

Before diving into comparing quotes, it’s crucial to understand the key components of an insurance policy that can impact your coverage and premiums. Make sure to pay attention to the following:

- Review coverage limits: Ensure that the coverage limits offered in each quote align with your needs, such as liability coverage, collision coverage, and comprehensive coverage.

- Assess deductibles: Compare the deductible amounts across different quotes and consider how they can affect your out-of-pocket expenses in the event of a claim.

- Check exclusions: Understand what is not covered under each policy to avoid surprises when filing a claim. Look out for specific exclusions that may impact your coverage.

Tips for Using Online Tools and Services

Utilizing online tools and services can streamline the quote comparison process and help you gather relevant information efficiently. Here are some tips to make the most of these resources:

- Use comparison websites: Take advantage of online platforms that allow you to input your information once and receive multiple quotes from different insurers for easy comparison.

- Utilize calculators: Some websites offer premium calculators that can help you estimate the cost of coverage based on your specific details, giving you a clearer picture of potential expenses.

- Read customer reviews: Look for feedback from other policyholders to gauge the quality of service and claims handling of insurance companies before making a decision.

Conclusive Thoughts

As we conclude our exploration of Shop Car Insurance Quotes to Get the Lowest Annual Premiums, remember that knowledge is power when it comes to making informed decisions about your auto insurance. By shopping around and understanding the key factors that influence premiums, you can drive with confidence knowing you have the best coverage at the most competitive rates.

Helpful Answers

Why is shopping around for car insurance quotes important?

Shopping around allows you to compare different offers and find the best coverage at the lowest annual premiums tailored to your needs.

How do personal factors like age and driving record affect car insurance premiums?

Personal factors like age and driving record can impact premium rates as insurance companies assess risk levels based on these factors.

What are some strategies for lowering car insurance premiums?

Maintaining a good driving record, bundling policies, improving credit score, and seeking discounts are effective ways to reduce premium costs.

How can online tools help in comparing car insurance quotes effectively?

Online tools simplify the quote comparison process by allowing you to review coverage limits, deductibles, and exclusions from various providers in one place.