How to Customize Auto Policy Quotes for Your Needs delves into the intricacies of tailoring insurance quotes to individual requirements, offering a detailed exploration that is sure to captivate readers.

The following paragraphs will provide a wealth of information on understanding, assessing, and customizing auto policy quotes to ensure optimal coverage.

Understanding Auto Policy Quotes

When looking to insure your vehicle, it is essential to understand auto policy quotes to make an informed decision. Auto policy quotes consist of various components that determine the coverage and cost of your insurance plan. Factors such as your driving record, vehicle type, coverage limits, and deductibles all play a role in shaping your policy quote.

Components of an Auto Policy Quote:

- Liability Coverage: This covers damages and injuries you cause to others in an accident.

- Collision Coverage: Protects your vehicle in case of an accident with another vehicle or object.

- Comprehensive Coverage: Covers damages from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you in case you are in an accident with a driver who has insufficient or no insurance.

Factors Influencing Auto Policy Quotes:

- Driving Record: A clean driving record usually leads to lower premiums.

- Vehicle Type: The make, model, and age of your vehicle can impact your quote.

- Coverage Limits: Higher coverage limits typically result in higher premiums.

- Deductibles: Choosing a higher deductible can lower your premium but means paying more out of pocket in case of a claim.

Importance of Customizing Policy Quotes:

Customizing your auto policy quote is crucial to ensure that you have the right coverage for your individual needs. By tailoring your policy to fit your specific circumstances, you can avoid overpaying for unnecessary coverage or being underinsured in case of an accident.

It’s essential to review and adjust your policy regularly to reflect any changes in your driving habits, vehicle, or financial situation.

Assessing Your Coverage Needs

When it comes to assessing your coverage needs for auto insurance, it’s essential to consider various factors to ensure you have adequate protection in place. Evaluating your coverage requirements involves looking at your driving habits, personal circumstances, and financial situation to determine the types and levels of coverage that best suit your needs.

Types of Coverage Options

- Liability Coverage: This type of coverage helps pay for injuries and damages to others if you’re at fault in an accident.

- Collision Coverage: Covers damage to your vehicle in case of a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers regardless of who is at fault in an accident.

Impact of Personal Factors

- Driving History: A clean driving record may result in lower premiums, while a history of accidents or violations could increase insurance costs.

- Vehicle Type: The make, model, and age of your vehicle can affect the cost of insurance, with newer or more expensive cars typically requiring higher coverage levels.

- Usage Patterns: How often and how far you drive can impact your coverage needs, as more time on the road may increase the risk of accidents.

Customizing Policy Quotes

When it comes to customizing an auto policy quote, there are several steps you can take to tailor it to your specific needs. By comparing and contrasting different coverage options, adjusting deductibles, and coverage limits, you can create a policy that aligns with your individual requirements.

Comparing and Contrasting Coverage Options

- Begin by evaluating the various coverage options available, such as liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

- Understand what each type of coverage entails and how it can benefit you in different scenarios.

- Compare the costs associated with each type of coverage and prioritize based on your budget and needs.

- Consider the value of bundling different types of coverage for potential discounts or benefits.

Adjusting Deductibles and Coverage Limits

- Assess your financial situation and risk tolerance to determine the appropriate deductible for your policy.

- Higher deductibles typically result in lower premiums but require you to pay more out of pocket in the event of a claim.

- Consider increasing or decreasing your coverage limits based on the value of your assets and potential liability exposure.

- Ensure that your coverage limits are sufficient to protect you in a worst-case scenario.

Utilizing Online Tools and Resources

Online tools and resources have made it easier than ever to customize auto policy quotes to fit your specific needs. By utilizing various platforms and calculators available online, you can compare quotes from different insurance providers and adjust coverage options to find the best policy for you.

Popular Online Platforms for Customizable Auto Policy Quotes

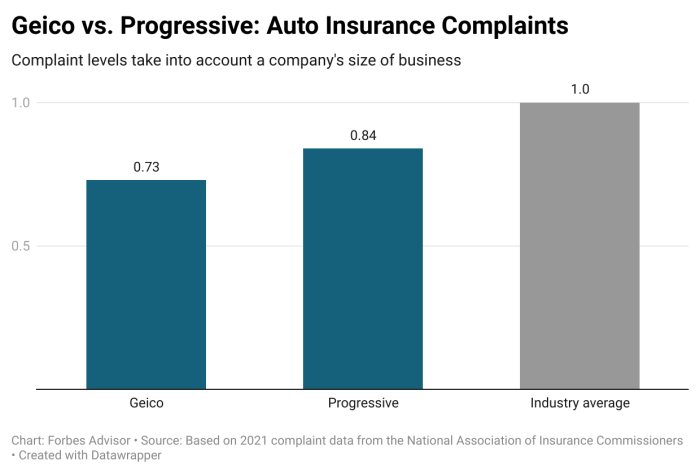

- Progressive: Progressive offers an online tool where you can customize your auto policy quotes by adjusting coverage options and deductibles.

- GEICO: GEICO’s website provides a user-friendly interface for customizing auto policy quotes based on your coverage needs.

- Allstate: Allstate’s online platform allows you to input your information and preferences to receive personalized auto policy quotes.

Using Online Calculators to Adjust Coverage Options

- Online calculators provided by insurance companies allow you to input information such as your driving history, vehicle details, and coverage preferences to adjust your policy quotes accordingly.

- By using these calculators, you can easily see how changing coverage options like liability limits, deductibles, and additional coverage types can impact your overall policy cost.

- Make sure to input accurate information to get the most precise quotes and ensure that the coverage options meet your specific needs.

Benefits of Using Digital Tools to Compare Quotes

- Convenience: Online tools allow you to compare quotes from multiple insurance providers without the need to visit different offices or make numerous phone calls.

- Time-saving: Instead of manually requesting quotes from each provider, digital tools provide instant results for easy comparison in one place.

- Cost-effective: By comparing quotes online, you can find the most competitive rates and potentially save money on your auto insurance policy.

Seeking Professional Advice

Seeking professional advice from insurance agents or brokers is crucial when customizing auto policy quotes to ensure you have the right coverage for your needs. These professionals have the expertise to guide you through the process and help you make informed decisions.

Tips for Effective Communication

- Be clear about your driving habits and the type of coverage you are looking for.

- Provide details about your vehicle, including make, model, and usage.

- Discuss any specific concerns or preferences you have regarding your coverage.

- Ask questions if you are unsure about any aspect of the policy or coverage options.

Benefits of Personalized Advice

- Customized solutions tailored to your individual needs and budget.

- Access to expert knowledge and guidance to help you make informed decisions.

- Assistance in navigating complex insurance terms and coverage options.

- Potential cost savings by ensuring you are not overpaying for unnecessary coverage.

Concluding Remarks

In conclusion, How to Customize Auto Policy Quotes for Your Needs equips you with the knowledge and tools to navigate the world of insurance quotes with confidence and precision.

FAQ Section

What factors can influence auto policy quotes?

Factors such as driving history, vehicle type, and coverage requirements can impact auto policy quotes. It’s essential to customize quotes based on these factors.

How can I effectively communicate my coverage needs to insurance professionals?

To effectively communicate your coverage needs, prepare a list of your requirements and preferences beforehand. Clearly articulate what you’re looking for in terms of coverage and budget.

Why is it important to adjust deductibles and coverage limits when customizing policy quotes?

Adjusting deductibles and coverage limits allows you to tailor your policy to your specific needs. It can help you find the right balance between coverage and affordability.