As Business Bank Accounts with the Best Interest Rates in 2025 takes center stage, this guide invites readers to delve into the world of financial opportunities. Understanding the impact of interest rates on businesses is crucial for financial success, and this guide aims to shed light on the best practices and factors to consider when selecting a business bank account.

Overview of Business Bank Accounts with the Best Interest Rates in 2025

Interest rates play a crucial role in the financial landscape for businesses, affecting their growth and stability. Choosing a business bank account with competitive interest rates is essential for maximizing returns on idle funds and enhancing overall financial health. Businesses should carefully consider various factors when selecting a bank account, including interest rates, to ensure they meet their financial objectives.

Factors Influencing Interest Rates on Business Bank Accounts

The interest rates on business accounts in 2025 are influenced by several factors, such as economic conditions, market trends, and banking policies. These factors can impact the rates offered by financial institutions and determine the competitiveness of the interest rates available to businesses.

Additionally, different types of business accounts, such as savings and checking accounts, may offer varying interest rates based on their structure and purpose. The size and type of business can also influence the interest rates offered by banks, as larger businesses may have access to more favorable rates compared to smaller enterprises.

Best Practices for Maximizing Interest Rates on Business Accounts

- Regularly review interest rates offered by different banks to identify the most competitive options for your business.

- Negotiate with banks to secure better interest rates based on your business’s financial profile and banking needs.

- Maintain a positive banking relationship by demonstrating responsible financial behavior and utilizing additional services offered by the bank.

- Utilize interest-bearing accounts effectively to maximize returns on idle funds and improve overall financial performance.

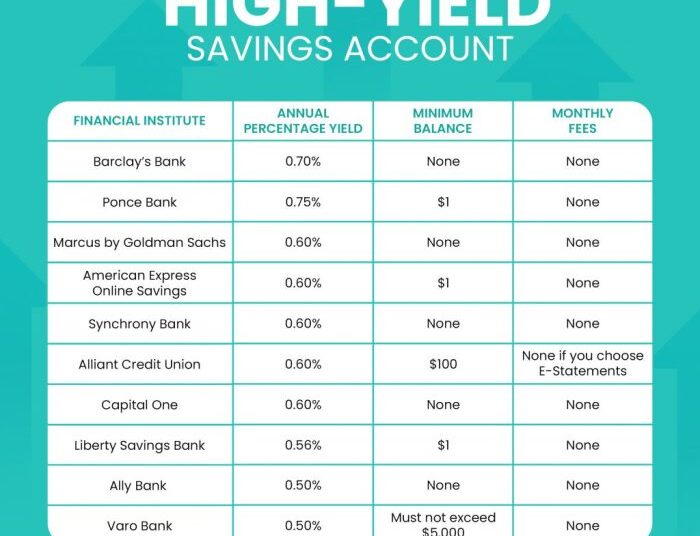

Comparison of Business Bank Accounts Offering the Best Interest Rates

| Bank/Financial Institution | Interest Rates | Account Features | Eligibility Requirements |

|---|---|---|---|

| Bank A | 2.5% | Online banking, mobile app, unlimited transactions | Minimum balance of $10,000 |

| Bank B | 3.0% | High-yield savings account, 24/7 customer support | Minimum balance of $5,000 |

| Bank C | 2.75% | Free business checks, cashback rewards | No minimum balance requirement |

Closing Notes

In conclusion, navigating the landscape of Business Bank Accounts with the Best Interest Rates in 2025 requires careful consideration and strategic planning. By implementing the tips and insights shared in this guide, businesses can make informed decisions to optimize their financial growth and stability.

FAQ Corner

What factors should businesses consider when selecting a bank account based on interest rates?

Businesses should consider the current economic conditions, market trends, and their own financial goals when choosing a bank account with competitive interest rates.

How can businesses negotiate better interest rates with banks?

Businesses can negotiate better interest rates by maintaining a positive banking relationship, demonstrating their financial stability, and exploring different account options.

Do different types and sizes of businesses impact the interest rates offered by banks?

Yes, the size and type of business can influence the interest rates offered by banks. Larger businesses may have more negotiating power compared to small businesses.