Exploring the ins and outs of selecting the perfect business line of credit in 2025, this introduction sets the stage for a deep dive into crucial considerations and decision-making processes. With a blend of informative insights and practical tips, readers are sure to gain valuable knowledge on this essential topic.

Moving forward, let’s dissect the key factors to keep in mind when navigating the realm of business lines of credit in the upcoming year.

Factors to Consider When Choosing a Business Line of Credit

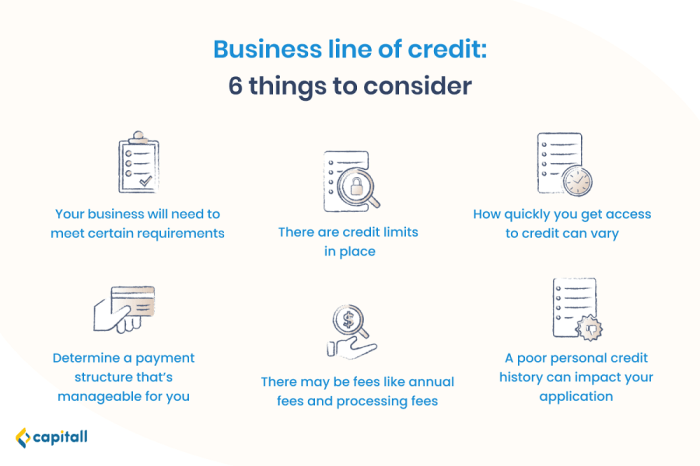

When selecting a business line of credit, there are several key factors to take into account to ensure you make the best choice for your company’s financial needs.

Identify the financial needs of your business

- Determine the specific purpose for which you require the line of credit, whether it’s for managing cash flow, purchasing inventory, or funding expansion projects.

- Calculate the amount of credit needed based on your business’s financial projections and requirements.

Compare interest rates and fees from different lenders

- Research and compare the interest rates offered by various financial institutions to find the most competitive option.

- Consider the additional fees and charges associated with the line of credit, such as annual fees, draw fees, or early repayment penalties.

Discuss the importance of credit score requirements

- Understand the credit score requirements set by lenders and assess whether your business meets these criteria.

- Improving your credit score can help you qualify for lower interest rates and higher credit limits.

Explain the flexibility of repayment terms

- Explore the repayment terms offered by different lenders, including the repayment schedule, interest accrual, and any flexibility in repayment options.

- Choose a line of credit with repayment terms that align with your business’s cash flow and financial capabilities.

Types of Business Lines of Credit Available in 2025

In 2025, businesses have a variety of options when it comes to securing a line of credit. Understanding the different types available can help business owners make informed decisions to meet their financial needs.

Traditional vs. Online Lenders

Traditional lenders, such as banks and credit unions, offer business lines of credit with strict eligibility criteria and longer approval processes. On the other hand, online lenders provide faster approvals, often with more flexible terms, but may come with higher interest rates.

Secured and Unsecured Credit Lines

Secured business lines of credit require collateral, such as business assets or personal guarantees, to secure the loan. Unsecured credit lines, on the other hand, do not require collateral but may have higher interest rates to compensate for the increased risk to the lender.

Benefits of Revolving Credit Lines

Revolving credit lines allow businesses to borrow funds up to a predetermined credit limit, repay the borrowed amount, and borrow again without reapplying. This flexibility can be advantageous for managing cash flow fluctuations and unexpected expenses.

Impact of Personal and Business Credit

Both personal and business credit scores play a significant role in determining the availability and terms of a business line of credit. A strong credit history can help secure better interest rates and higher credit limits, while a poor credit history may limit options or result in higher costs.

Application Process for a Business Line of Credit

When applying for a business line of credit, there are specific steps and requirements that need to be followed. Here is a breakdown of the application process to help you navigate through it smoothly.

Documentation Required for the Application

- Business financial statements

- Personal and business tax returns

- Business plan or projections

- Business bank statements

- Legal documents such as business licenses and registrations

Timeline for Approval and Funding

- The approval process typically takes anywhere from a few days to a few weeks, depending on the lender.

- Once approved, funding can happen within a few days to a couple of weeks, again depending on the lender and their processes.

Steps Involved in the Underwriting Process

- Lender reviews the application and documentation provided

- Credit check and assessment of the business’s financial health

- Determination of credit limit and terms

- Signing of the agreement by both parties

Tips for Improving Chances of Approval

- Maintain a good credit score

- Provide accurate and detailed financial information

- Show steady revenue and business growth

- Have a well-thought-out business plan

- Establish a good relationship with the lender

Managing and Utilizing a Business Line of Credit

When it comes to managing and utilizing a business line of credit, there are several key strategies that can help you make the most of this financial tool. Responsible borrowing, improving cash flow, monitoring credit utilization, and knowing when to tap into your credit line are all crucial aspects to consider.

Strategies for Responsible Borrowing

- Only borrow what you need: Resist the temptation to max out your credit line. Borrow only the amount necessary to cover your immediate expenses.

- Plan for repayment: Have a clear repayment plan in place before borrowing. Make sure you can comfortably meet the repayment schedule to avoid financial strain.

- Avoid using credit for non-essential expenses: Use your credit line for business-related expenses only to prevent unnecessary debt accumulation.

Using a Credit Line to Improve Cash Flow

- Bridge cash flow gaps: A business line of credit can be used to cover short-term cash flow fluctuations, ensuring you can meet operational expenses even during slow periods.

- Take advantage of opportunities: Use your credit line to capitalize on business opportunities that require immediate funding, such as inventory purchases or equipment upgrades.

- Invest in growth: Utilize your credit line to invest in initiatives that can drive business growth, such as marketing campaigns or expansion projects.

Importance of Monitoring Credit Utilization

- Track your spending: Regularly monitor your credit line usage to ensure you are staying within your limits and not overspending.

- Avoid credit score impact: By keeping a close eye on your credit utilization, you can prevent negative impacts on your credit score that may result from high balances.

- Identify areas for improvement: Monitoring credit utilization can help you identify areas where you can cut costs or optimize spending to enhance financial efficiency.

Scenarios Where Tapping into a Credit Line is Beneficial

- Emergency expenses: When unexpected expenses arise, tapping into your credit line can provide the necessary funds to address the situation promptly.

- Seasonal fluctuations: During seasonal slowdowns, using a credit line can help bridge the gap until business picks up again.

- Cyclical investments: For businesses with cyclical revenue streams, a credit line can support investments during slower periods and be repaid when cash flow improves.

Final Thoughts

In conclusion, the journey of understanding how to choose the right business line of credit in 2025 has been enlightening. By grasping the intricacies of financial needs, credit score requirements, and repayment terms, individuals and businesses can make informed decisions to propel their ventures forward with confidence.

Frequently Asked Questions

What documents are needed when applying for a business line of credit?

Typically, lenders require proof of income, business financial statements, and personal identification documents.

How long does it usually take to get approved for a business line of credit?

The approval process can vary but generally takes a few days to a couple of weeks, depending on the lender and complexity of the application.

Can using a business line of credit help improve cash flow?

Absolutely, strategically utilizing a credit line can provide a financial cushion during slow periods and improve overall cash flow management.