Embark on a journey to master the art of managing invoices with QuickBooks Self-Employed. Discover the key strategies and tips that will elevate your invoicing game to professional levels, ensuring efficiency and accuracy in your financial processes.

Introduction to QuickBooks Self-Employed

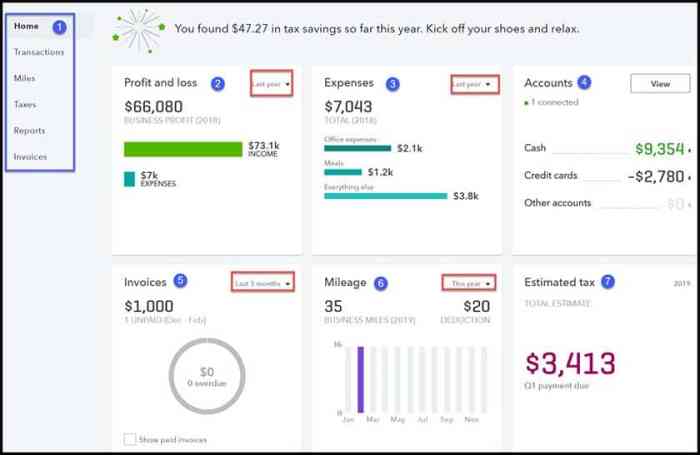

QuickBooks Self-Employed is a specialized accounting software designed for freelancers, independent contractors, and self-employed individuals. It offers a range of features to help users manage their finances efficiently and stay organized.

Key Features of QuickBooks Self-Employed

- Automated expense tracking

- Easy invoicing and receipt capture

- Mileage tracking

- Tax deduction maximization

Benefits of Using QuickBooks Self-Employed for Managing Invoices

- Streamlined invoicing process

- Organized record-keeping for tax purposes

- Real-time tracking of payments

- Integration with bank accounts for easy reconciliation

Professions and Industries That Can Benefit from QuickBooks Self-Employed

- Freelancers in graphic design, writing, or web development

- Consultants and coaches

- Photographers and videographers

- Independent contractors in various fields

Setting Up Invoices in QuickBooks Self-Employed

When it comes to managing your invoices efficiently, QuickBooks Self-Employed offers a user-friendly platform to create and customize invoices tailored to your business needs.

Creating a New Invoice

To set up a new invoice in QuickBooks Self-Employed, follow these steps:

- Log in to your QuickBooks Self-Employed account.

- Go to the Invoices tab and click on “Create Invoice.”

- Enter the necessary details such as customer information, products/services provided, quantity, rate, and any applicable taxes.

- Review the invoice for accuracy and then save or send it directly to your client.

Customizing Invoice Templates

Customizing your invoice templates allows you to add a personal touch and align them with your branding. Here are some guidelines:

- Click on the Gear icon in the top right corner and select “Customize look and feel.”

- Choose a template that suits your business style.

- Modify the font, color scheme, and layout to reflect your brand identity.

- Save your customized template for future use.

Adding Company Logos and Payment Terms

Including your company logo and payment terms on your invoices enhances professionalism and clarity. Here’s how:

- Upload your company logo by going to “Customize look and feel” and selecting the Logo section.

- Set payment terms, such as due date and accepted payment methods, under the Payment terms section in the invoice settings.

- Ensure all essential details like invoice number, issue date, and contact information are prominently displayed.

Managing Invoice Payments

In QuickBooks Self-Employed, managing invoice payments is essential for maintaining accurate financial records and ensuring timely payments from clients. Tracking payments received against issued invoices, reconciling payments, and handling overdue invoices effectively are crucial aspects of managing invoice payments.To track payments received against issued invoices in QuickBooks Self-Employed, follow these steps:

- Navigate to the “Invoices” tab in QuickBooks Self-Employed.

- Locate the invoice for which you have received payment.

- Mark the invoice as “Paid” and enter the payment details, including the date and amount received.

- Ensure that the payment is correctly recorded to reflect the updated financial status.

Best practices for reconciling payments and ensuring accurate financial records include:

- Regularly reviewing and updating payment statuses to reflect the most recent transactions.

- Reconciling payments with bank statements to identify any discrepancies or missing payments.

- Keeping detailed records of all payments received and issued invoices for reference and auditing purposes.

To send payment reminders and handle overdue invoices effectively in QuickBooks Self-Employed:

- Set up automated payment reminders to notify clients of upcoming or overdue payments.

- Customize payment reminder templates to include personalized messages and payment instructions.

- Follow up with clients via email or phone to address overdue invoices and negotiate payment terms if necessary.

- Use the reporting features in QuickBooks Self-Employed to track overdue invoices and take appropriate actions to resolve outstanding payments.

Sending Payment Reminders and Handling Overdue Invoices

Sending payment reminders and handling overdue invoices is crucial for maintaining healthy cash flow and client relationships. Here are some tips to effectively manage overdue invoices:

- Send friendly payment reminders before the due date to prompt clients to make timely payments.

- Offer flexible payment options or payment plans to accommodate clients experiencing financial difficulties.

- Follow up with clients promptly after the due date has passed to address any outstanding payments and prevent further delays.

- Consider applying late fees or interest charges to incentivize clients to pay their invoices on time.

Generating Reports and Insights

Generating reports and gaining insights from invoice data is crucial for effective business management. QuickBooks Self-Employed offers robust reporting capabilities to track invoice statuses, payments, and overall financial health. By utilizing these features, you can make informed decisions to improve cash flow management and profitability.

Detailed Reporting Capabilities

QuickBooks Self-Employed allows you to generate various reports related to invoicing, such as:

- Invoice status reports: Track the status of each invoice, including pending, paid, or overdue.

- Payment reports: Monitor payments received and outstanding balances for each invoice.

- Profit and loss reports: Analyze the overall impact of invoicing on your business’s financial health.

These reports provide valuable insights into your invoicing process, helping you identify areas for improvement and optimize your cash flow.

Financial Insights for Decision-Making

By generating financial reports related to invoicing in QuickBooks Self-Employed, you can gain insights such as:

- Identifying trends: Spot patterns in invoice payments to anticipate cash flow fluctuations.

- Monitoring profitability: Analyze which clients or services generate the most revenue to focus on high-profit opportunities.

- Forecasting cash flow: Use historical invoice data to predict future income and expenses for better financial planning.

These insights enable you to make data-driven decisions that enhance your business’s financial performance and sustainability.

Analyzing Invoice Data for Optimization

To improve cash flow management and profitability, consider analyzing invoice data in QuickBooks Self-Employed by:

- Reviewing payment timelines: Identify delays in payments to streamline your invoicing process and enhance cash flow.

- Adjusting pricing strategies: Evaluate the profitability of your services based on invoice data to optimize pricing and increase revenue.

- Implementing automation: Utilize tools in QuickBooks Self-Employed to automate invoicing and payment reminders for efficiency.

By analyzing invoice data effectively, you can streamline your invoicing operations, boost profitability, and ensure sustainable business growth.

Integrations and Automation

Integrating QuickBooks Self-Employed with other tools and platforms can significantly streamline the invoicing process for freelancers and small business owners. Additionally, leveraging automation features within QuickBooks Self-Employed can help in generating invoices efficiently and following up on payments.

Integrations with Other Tools

- Integrating QuickBooks Self-Employed with payment gateways like PayPal or Stripe allows for easy collection of payments directly through invoices.

- Integration with project management tools such as Trello or Asana can help in syncing project details with invoice generation, ensuring accurate billing for services rendered.

- Connecting QuickBooks Self-Employed with time tracking apps like TSheets or Harvest can automate the process of tracking billable hours and including them in invoices.

Automation Features in QuickBooks Self-Employed

- Automated invoice generation: Set up recurring invoices for regular clients, saving time on manual invoice creation each month.

- Automatic payment reminders: Configure the system to send reminders to clients for overdue payments, improving cash flow management.

- Auto-categorization of expenses: QuickBooks Self-Employed can automatically categorize expenses, making it easier to track and include them in invoices.

Tips for Efficient Invoice Management

- Regularly review and update integration settings to ensure seamless data transfer between platforms.

- Utilize automation features for repetitive tasks to free up time for focusing on business growth and client relationships.

- Customize invoice templates to reflect your brand identity and provide a professional image to clients.

Final Wrap-Up

As we conclude our discussion on managing invoices like a pro using QuickBooks Self-Employed, remember that the key to financial success lies in effective invoice management. By leveraging the features and tools offered by QuickBooks Self-Employed, you can streamline your invoicing process and pave the way for a more prosperous business future.

Frequently Asked Questions

How can I customize my invoice templates in QuickBooks Self-Employed?

You can easily customize your invoice templates in QuickBooks Self-Employed by selecting the template you want to customize, then clicking on the “Edit” option to make changes to fields such as company logo, payment terms, and other details.

Can QuickBooks Self-Employed automatically send payment reminders for overdue invoices?

Yes, QuickBooks Self-Employed offers the feature to automatically send payment reminders for overdue invoices. You can set up the frequency and content of these reminders to ensure timely payments from your clients.