Embark on the journey of Opening a Global Business Bank Account with this comprehensive guide that will walk you through the necessary steps and considerations. Starting from researching international banking options to managing currency exchange, this guide covers it all in a detailed yet easy-to-understand manner.

Researching International Banking Options

When looking to open a global business bank account, it is crucial to conduct thorough research on international banking options to ensure the best fit for your company’s needs.

Key Factors to Consider

- Accessibility and convenience of online banking services

- Availability of multi-currency accounts

- Fee structures for international transactions

- Customer service quality and support for global clients

Choosing a Bank with a Strong Global Presence

Opting for a bank with a strong global presence can offer numerous advantages, such as:

- Access to a wider network of ATMs and branches worldwide

- Ease of international fund transfers and transactions

- Expertise in navigating global financial regulations and compliance

Local vs. International Banks for Global Business Accounts

While local banks may offer familiarity and easier communication, international banks often provide:

- Specialized global banking services tailored to international businesses

- Greater flexibility in managing multi-currency accounts and transactions

- Enhanced security measures for international transactions

Assessing a Bank’s Reputation and Stability

It is essential to evaluate a bank’s reputation and stability before entrusting them with your international transactions. Look for:

- Longevity and track record in handling global transactions

- Financial strength and credit ratings from reputable agencies

- Reviews and feedback from other global businesses utilizing their services

Understanding Legal and Regulatory Requirements

Opening a global business bank account involves understanding the legal and regulatory requirements specific to each jurisdiction. Here are some key aspects to consider:

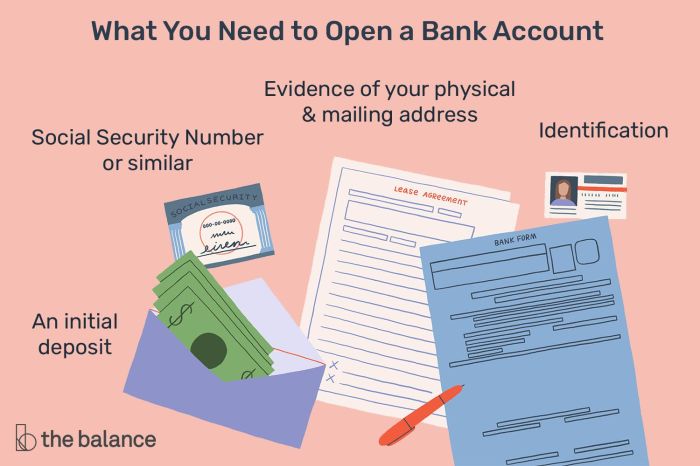

Documentation Needed for Opening a Global Business Bank Account

When opening a global business bank account, you typically need to provide certain documentation. This may include:

- Proof of identity for all directors, shareholders, and authorized signatories

- Proof of address for all relevant parties

- Company registration documents

- Business plan and financial statements

- Tax identification number

Compliance Procedures for KYC and AML Regulations

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are crucial in international banking. Banks will verify the identity of account holders and monitor transactions to prevent money laundering and other illicit activities.

Impact of Different Legal Jurisdictions

The legal jurisdiction in which you operate can have a significant impact on opening a business account. Some countries may have stricter regulations or requirements, while others may offer more flexibility. It’s essential to understand the legal framework in each jurisdiction to navigate the process effectively.

Navigating Tax Implications for International Banking Operations

International banking operations can have complex tax implications. It’s important to consider factors such as double taxation treaties, withholding taxes, and reporting requirements in different jurisdictions. Seeking professional advice from tax experts can help ensure compliance and mitigate tax risks.

Selecting the Right Account Type

When it comes to opening a global business bank account, choosing the right account type is crucial for facilitating international transactions and managing your finances effectively.Some of the various types of global business bank accounts available include:

- Traditional Business Accounts

- Multi-Currency Accounts

- Offshore Business Accounts

Essential Features for International Transactions

- Ability to send and receive international wire transfers

- Foreign exchange services for converting currencies

- Online banking platforms with multi-language support

- Dedicated relationship managers for personalized service

Differences Between Multi-Currency and Traditional Business Accounts

Multi-currency accounts allow you to hold and manage funds in different currencies within the same account, making it easier to conduct transactions in various markets. Traditional business accounts typically only support one currency, requiring conversion for international transactions.

Choosing the Best Account Type for Your Global Business

Consider the nature of your business, the countries you will be operating in, and the volume of international transactions you expect to make. If your business deals with multiple currencies regularly, a multi-currency account would be more suitable. On the other hand, if you primarily operate in one currency but occasionally conduct international transactions, a traditional business account may suffice.

Managing Currency Exchange and Transfer Fees

Currency exchange fees and transfer fees can significantly impact the costs of operating a global business. It is crucial to have strategies in place to minimize these expenses and optimize your international transactions.

Minimizing Currency Exchange Fees

When dealing with currency exchange, consider using a multi-currency account to hold different currencies without the need for frequent conversions. This can help reduce exchange fees associated with converting funds back and forth. Additionally, keep an eye on exchange rates and consider bulk conversions during favorable rates to save on fees.

Comparing International Fund Transfer Methods

- Bank Transfers: Traditional bank transfers can be costly due to high fees and unfavorable exchange rates set by banks.

- Online Payment Platforms: Services like PayPal or TransferWise offer lower fees and competitive exchange rates for international transfers.

- Cryptocurrency: Utilizing cryptocurrencies like Bitcoin for international transfers can bypass traditional banking systems and their associated fees.

Understanding Exchange Rates Impact

Exchange rates play a crucial role in international transactions, affecting the final amount received after currency conversion. Be aware of fluctuating exchange rates and consider hedging strategies to mitigate risks associated with currency fluctuations.

Negotiating Favorable Transfer Fees

When selecting a global bank for your business account, leverage your account balance and transaction volume to negotiate lower transfer fees. Build a strong relationship with your bank to access preferential rates and reduced fees for international transfers.

Final Conclusion

In conclusion, Opening a Global Business Bank Account involves a series of crucial decisions and steps that can impact the success of your international business operations. By following this guide diligently, you can navigate the complexities of global banking with confidence and efficiency.

FAQ Summary

What are some key factors to consider when researching global banking institutions?

Factors to consider include the bank’s global presence, reputation, stability, and services tailored for international businesses.

What documentation is typically needed to open a global business bank account?

Commonly required documents include proof of identity, business registration, and financial statements.

What are some strategies to minimize currency exchange fees when operating a global business?

Strategies include using multi-currency accounts, choosing banks with competitive rates, and consolidating transactions to reduce fees.