Embark on the journey to Secure Your Startup: The Best Business Credit Lines in 2025, where we delve into the crucial aspects of securing financial stability for your new venture.

Providing insights into the various types of business credit lines, eligibility criteria, and tips for obtaining the best deals, this guide equips startups with the knowledge needed to thrive in the competitive business landscape.

Overview of Business Credit Lines in 2025

In 2025, business credit lines are more crucial than ever for startups looking to secure funding for their ventures. These credit lines offer flexibility and convenience compared to traditional loans, providing businesses with access to a revolving credit limit that can be drawn upon as needed.

Importance of Business Credit Lines

Business credit lines play a vital role in helping startups manage their cash flow effectively. They provide a safety net for unexpected expenses, allow for quick access to funds, and help build a credit history for the business.

Differences from Traditional Loans

Unlike traditional loans that provide a lump sum of money upfront, business credit lines offer a revolving credit limit that can be used multiple times as long as the borrower stays within the set limit. This flexibility allows startups to borrow only what they need when they need it, reducing the overall cost of borrowing.

Key Trends in 2025

- Increased Integration of Technology: Business credit lines in 2025 are heavily influenced by technological advancements, with more lenders offering online applications, instant approvals, and digital payment options.

- Personalized Financing Solutions: Lenders are tailoring credit lines to meet the specific needs of startups, offering customized terms, interest rates, and repayment options based on the individual business’s financial situation.

- Focus on Sustainability: In 2025, there is a growing emphasis on sustainable business practices, and many lenders are offering credit lines to startups that demonstrate a commitment to environmental and social responsibility.

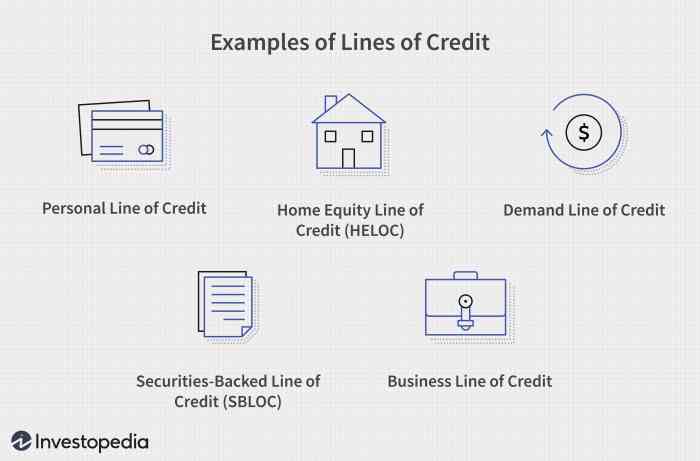

Types of Business Credit Lines

When it comes to business credit lines for startups, there are various types available to choose from. Understanding the differences between secured and unsecured credit lines is crucial for making informed financial decisions for your business.

Secured Business Credit Lines

Secured business credit lines are backed by collateral, such as inventory, equipment, or real estate. These credit lines are considered less risky for lenders, which often results in lower interest rates for borrowers. However, the main drawback is that if you default on the loan, the lender has the right to seize the collateral to recoup their losses.

Unsecured Business Credit Lines

On the other hand, unsecured business credit lines do not require collateral, making them a more accessible option for startups with limited assets. However, due to the higher risk involved for lenders, unsecured credit lines typically come with higher interest rates and lower credit limits.

Startups with strong credit scores and financial histories may have an easier time qualifying for unsecured credit lines.Overall, the choice between secured and unsecured business credit lines depends on the specific needs and financial circumstances of your startup. It’s essential to weigh the pros and cons of each type carefully before making a decision that aligns with your business goals and financial capabilities.

Qualifying for Business Credit Lines

To qualify for business credit lines, startups need to meet specific criteria set by lenders. These criteria typically include factors such as the company’s revenue, time in business, and creditworthiness. Here are some tips on how startups can improve their chances of qualifying for business credit lines and the role of personal credit scores in this process.

Creditworthiness Criteria

- Establish a strong business credit profile by making timely payments on existing debts and maintaining a good credit history.

- Show steady revenue growth and profitability to demonstrate the financial stability of the business.

- Provide accurate and up-to-date financial statements to showcase the company’s financial health.

Improving Creditworthiness

- Monitor your credit report regularly and address any errors or discrepancies promptly.

- Reduce outstanding debt and maintain a low credit utilization ratio to improve credit scores.

- Build relationships with vendors and suppliers who report payments to business credit bureaus to establish a positive credit history.

Role of Personal Credit Scores

Personal credit scores can play a significant role in obtaining business credit lines, especially for startups with limited business credit history. Lenders may consider the personal credit scores of the business owners when evaluating creditworthiness. Maintaining a good personal credit score can help startups qualify for better terms and higher credit limits on business credit lines.

Best Business Credit Lines for Startups in 2025

When it comes to finding the best business credit lines for startups in 2025, there are several top options offered by various financial institutions. Each business credit line comes with its own set of features, benefits, interest rates, fees, and repayment terms.

Let’s compare and contrast some of the top choices available:

1. XYZ Bank Business Credit Line

XYZ Bank offers a business credit line specifically tailored for startups. The key features of this credit line include:

- Flexible credit limits based on the business’s needs

- Low-interest rates for the first year

- No annual fees for the first two years

- Easy online application process

2. ABC Credit Union Startup Line of Credit

ABC Credit Union provides a startup line of credit that is ideal for new businesses looking for financial support. Here are some of the features and benefits:

- Competitive interest rates with no hidden fees

- Quick approval process

- Access to financial advisors for personalized guidance

- Option to secure the credit line with business assets

3. DEF Financial Services Startup Funding Program

DEF Financial Services offers a unique startup funding program that combines a business credit line with mentorship and support. The main highlights of this program are:

- Interest-free period for the first six months

- Mentorship from industry experts

- Networking opportunities with other startups

- Flexible repayment terms based on business performance

Securing the Best Business Credit Line

Securing a business credit line for a startup involves several key steps to increase your chances of approval and secure favorable terms from lenders. It’s important to prepare a strong application and be strategic in your approach to negotiating with potential lenders.

Preparing a Strong Business Credit Line Application

When preparing your business credit line application, it’s essential to gather all the necessary documentation and information that lenders will require. This typically includes your business plan, financial statements, tax returns, and any other relevant documents that showcase the financial health and viability of your startup.

Additionally, be prepared to provide personal financial information, as lenders may require a personal guarantee from the business owner.

- Ensure all financial documents are up to date and accurate to present a clear picture of your startup’s financial standing.

- Highlight key achievements, milestones, and future growth projections in your business plan to demonstrate the potential for success.

- Be transparent about any existing debts or financial obligations to show lenders that you can manage credit responsibly.

Strategies for Negotiating Favorable Terms with Lenders

Negotiating favorable terms with lenders can help you secure the best business credit line for your startup. Here are some strategies to consider:

- Shop around and compare offers from multiple lenders to find the most competitive rates and terms.

- Highlight your startup’s unique selling points and growth potential to make a strong case for why you deserve favorable terms.

- Be prepared to negotiate on interest rates, repayment terms, and credit limits to ensure the credit line aligns with your business needs.

- Consider offering collateral or a personal guarantee to secure more favorable terms from lenders.

Ultimate Conclusion

In conclusion, Secure Your Startup: The Best Business Credit Lines in 2025 offers a roadmap to success, empowering startups to make informed decisions and secure the financial resources necessary for growth and sustainability.

FAQs

How do business credit lines in 2025 differ from traditional loans?

Business credit lines offer greater flexibility and convenience compared to traditional loans, allowing startups to access funds as needed and only pay interest on the amount borrowed.

What are the key trends shaping the business credit landscape in 2025?

The key trends include increased digitalization of financial services, emphasis on sustainability and social responsibility, and the rise of alternative lenders offering innovative credit solutions.

How can startups improve their creditworthiness to qualify for business credit lines?

Startups can improve their creditworthiness by maintaining a positive payment history, reducing debt levels, and ensuring accurate and up-to-date financial records.